A Planned Payment is a revenue or expenditure that is expected to occur in the future. It can be recurring payments like Internet bills, monthly fees, salaries… or one-time payments like borrowing money and paying it back later.

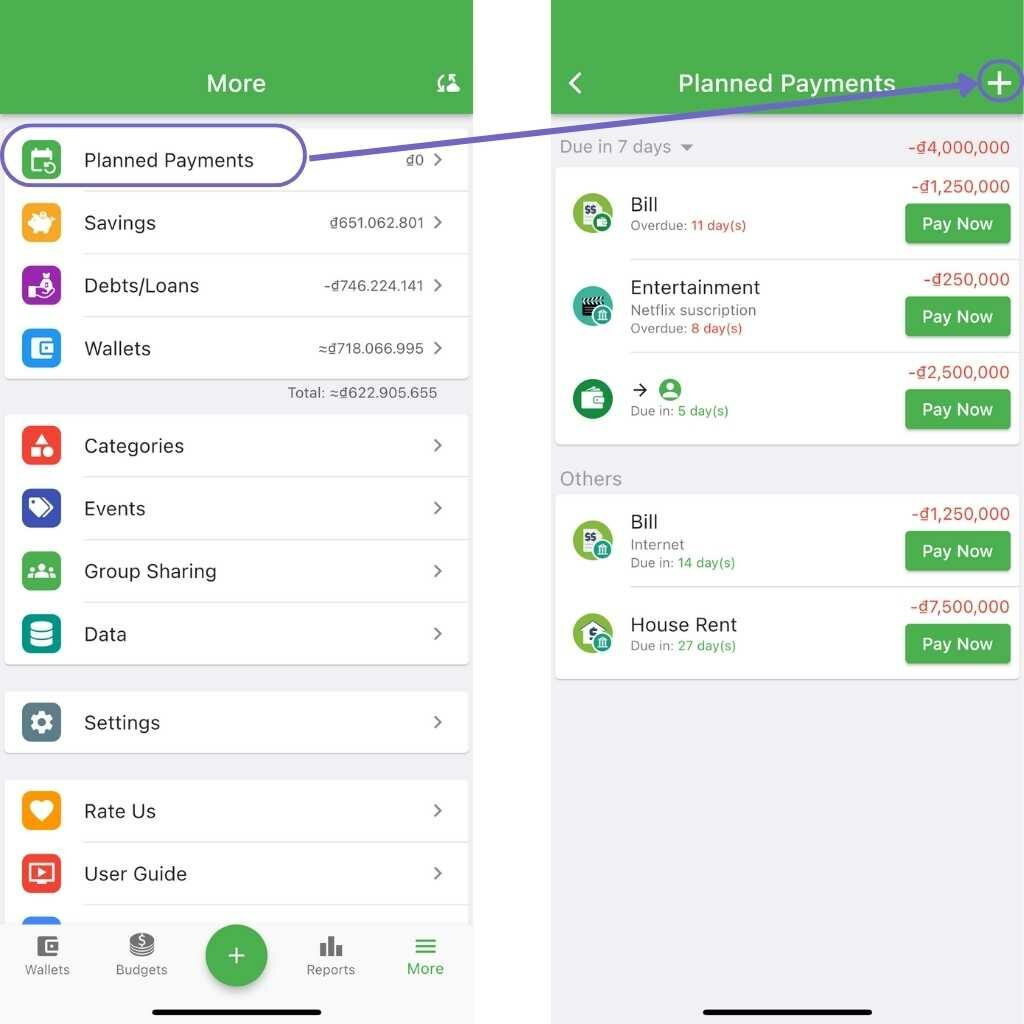

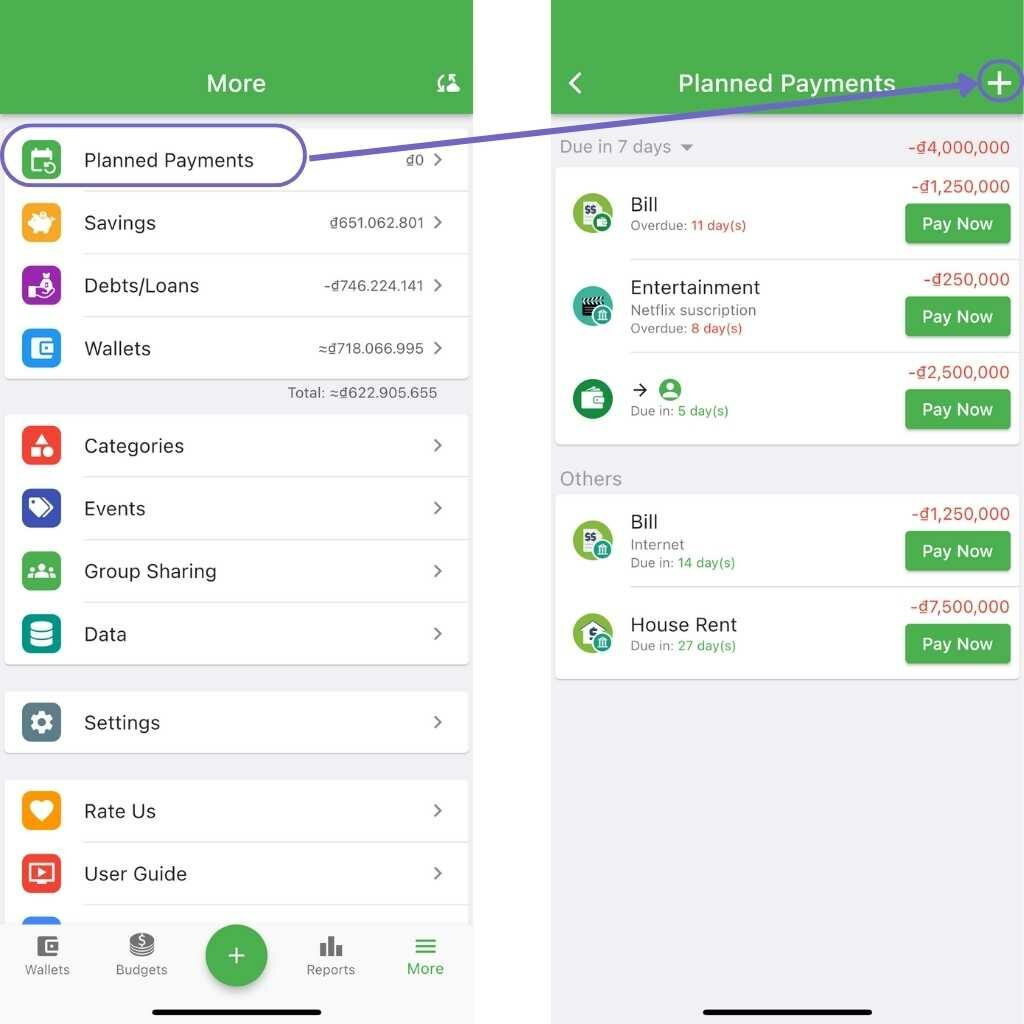

To create a planned payment, go to More > Planned Payments, then select the + icon in the upper right corner of the screen.

You can create four types of planned payment:

1. Recurring Transactions: Include recurring income (e.g., salary) or spending (e.g., Internet bill, monthly debt installment).

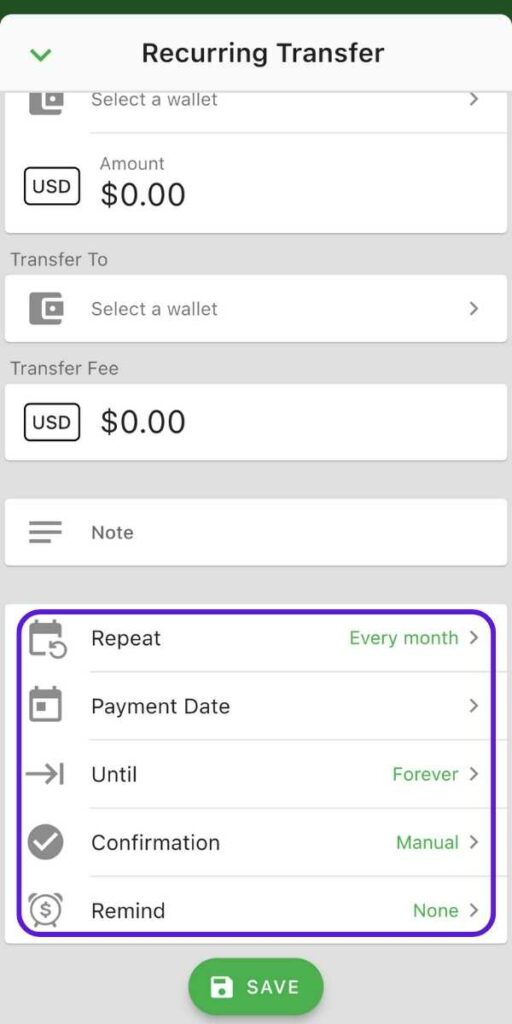

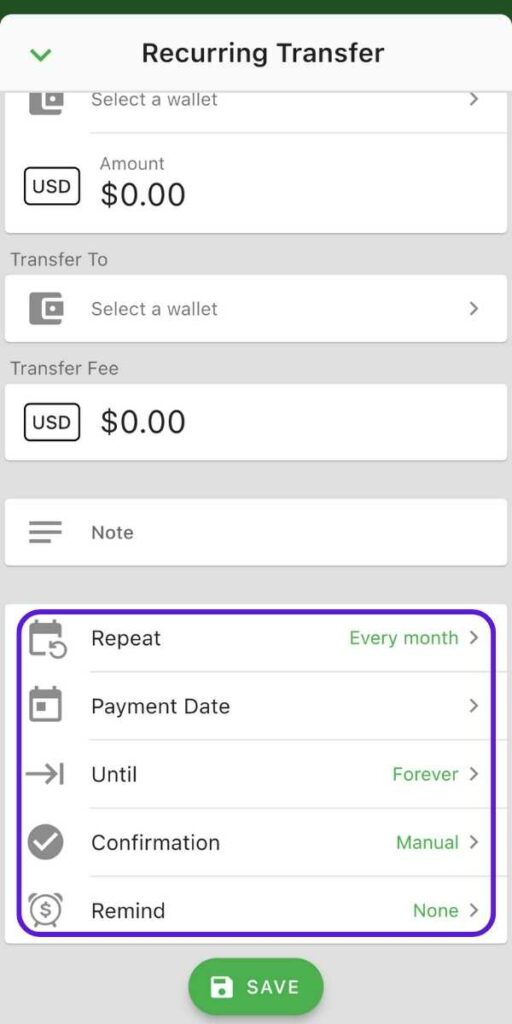

2. Recurring transfers: E.g., Monthly transfer to pay off credit card debt.

3. Recurring savings: Recurring open savings account.

4. Cumulative savings: Recurring deposits into a savings account.

Repeat: How often the transaction should occur.

Payment Date: The expected date the transaction will occur

Until: The expected end date of recurring transactions; you can choose the end date or how many times the transaction will occur (e.g., recur 48 times).

Confirmation: When the payment is due, the transaction will either automatically generate without your confirmation or you will have to confirm it manually.

Reminder: Sends an in-app notification to remind you that your payment date has arrived.

See some more tutorials:

- Getting Started with Smiley Budget & Money Manager

- Details Description of Transaction Fields

- Create and manage categories

- How to use Events (Labels)

- How to share data with your trusted people

- Create Savings Goals

Smiley Budget & Money Manager is one app for all your finances. You can track income, expenses, savings, debt, revenue and expenditure planning, cost control, bill payment reminders… You can download the app here.